Here at MAPI (Manufacturers Alliance for Productivity & Innovation), we’re passionate about data. We’re constantly asking our 2,300 members, all senior executives from manufacturing companies, how they handle the myriad management challenges they’re facing. Surveys are a fantastic way to take the pulse of manufacturing, and we’re excited to announce the release of the fourth edition of our State of B2B Social Media survey.

Since 2009, we’ve asked our member B2B manufacturers which social media sites they’re using, what value they get from them, how they measure that value, and what their top social goals are. We also drill down on what companies do differently as their social programs become increasingly mature. Our goal? To provide a great benchmark for industrials to understand the state of the social art in their peer group.

Here are the top 10 takeaways from this year’s report:

- The Big Four social sites continue to dominate.Based on the responses of 51 leading B2B manufacturers, the four most broadly used social media sites are YouTube, LinkedIn, Facebook, and Twitter.

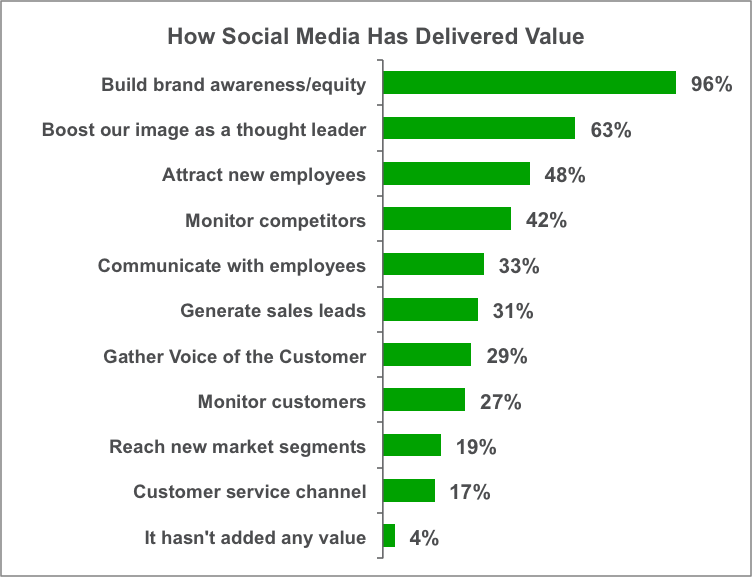

- Social is delivering more value than ever before.The primary value B2B manufacturers receive from their social media efforts is building brand awareness, not selling more products or services.

- Most companies don’t staff social as a full-time role. The majority of respondents (85%) allocate headcount on a part-time basis. Many of these employees spend no more than 10% of their time on social.

- Cheap and cheerful measurement tools remain on top. The most popular social media (and web) measurement tool is Google Analytics, used by 83% of respondents.

- B2B manufacturers spend 4% of the total marketing budget on social media.

- YouTube is most B2B manufacturers’ go-to social site. Every respondent rated YouTube effective for brand awareness, and 88% rated it effective for connecting with customers and prospects.

- Companies are becoming more socially mature. Compared to our 2012 results, 60% fewer companies consider themselves to be in the early phases of the social maturity curve, Listening and Ad Hoc.

- Social metrics aren’t one size fits all. Compared with their peers, companies with the most mature social programs were 11% less likely to rely on awareness metrics, 16% more likely to rely on engagement metrics, and 54% more likely to find purchase metrics helpful.

- Companies earlier in their social journey focus on building an audience. They place more emphasis on awareness metrics than their peers at later stages, who focus more on engagement and lead generation.

- Content is king. 98% cited creating quality content as their top social priority.

Members can click here to access the full results, which include links to download over 20 peer-generated social media policies, and great case studies from leading manufacturers like TimkenSteel, Lincoln Electric, Caterpillar, Mercury Marine, and Parker Hannifin.

Not a member but interested in learning more? Click here to attend our Nov. 18 Forum on Digital Marketing for Manufacturers.

Its great to see Cam as an industry expert for EP. I am a member of MAPI, which is a great organization, and am certain Cam is going to be a fabulous contributor

Thanks Ian!