Author: Thomas Haan, Principal, Global Equity Consulting, LLC

Overview

Below is the Global Equity Consulting / City Capital Advisors Report on the M&A activity in the Fluid Handling Industry (FHI) for the first half of 2016 (access in PDF format). The report covers M&A activity for manufacturers, distributors or service providers for dynamic (rotating or reciprocating) fluid handling equipment and related products – except drivers and power transmission products – for industrial markets.

In this report you will find information on:

- Industry deal activity levels by quarter for the last five years

- Most active companies

- Comments on each of the industry transactions in H1 2016

- Most targeted industrial segments

- Most targeted world wide geographies

- Disclosed valuations for deals announced in the last twelve months

The Report

This is a report on merger and acquisition transactions announced in the first and second quarters of 2016 for manufacturers, distributors or service providers for dynamic (rotating or reciprocating) fluid handling equipment and related products – except drivers and power transmission products – for industrial markets. The report is compiled by Global Equity Consulting, LLC and City Capital Advisors. Global Equity Consulting and City Capital Advisors provide merger and acquisition advisory services including: buy-side and sell-side representation, debt and equity capital formation, leveraged buyouts and ownership recapitalizations.

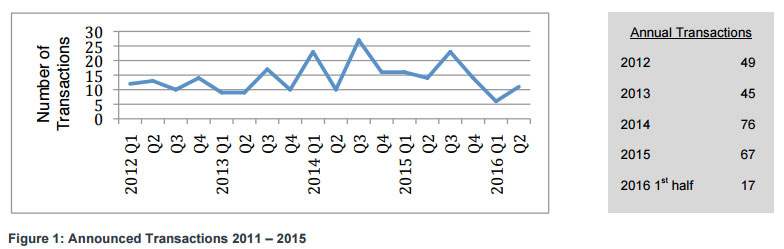

Industry Deal Activity Level

The industry transaction activity in the first half of 2016 declined 44% from the first half of 2015 with 17 announced transactions in the first half of 2016 compared to 30 announced transactions in the first half of 2015. Sequentially deal activity increased substantially in Q2 2016 with 11 transactions compared to only 6 in Q1 2016. The deal volume in Q1 2016 is the lowest level of activity in any quarter in the last 5 years. The boarder M&A market also has seen a slow down in deal volume the first half of 2016, particularly in Q1. Some reports speculate the fall off is due to more restrictive lending for private equity transactions but it would appear that the private equity activity in the fluid handling industry has not dropped off – three of the seventeen deals involved private equity add-ons or secondary transactions. In the fluid handling industry there is still a high demand for quality acquisitions so the slow down in deal activity may be a reflection of the supply of quality acquisitions available and perhaps an imbalance in valuation expectations.

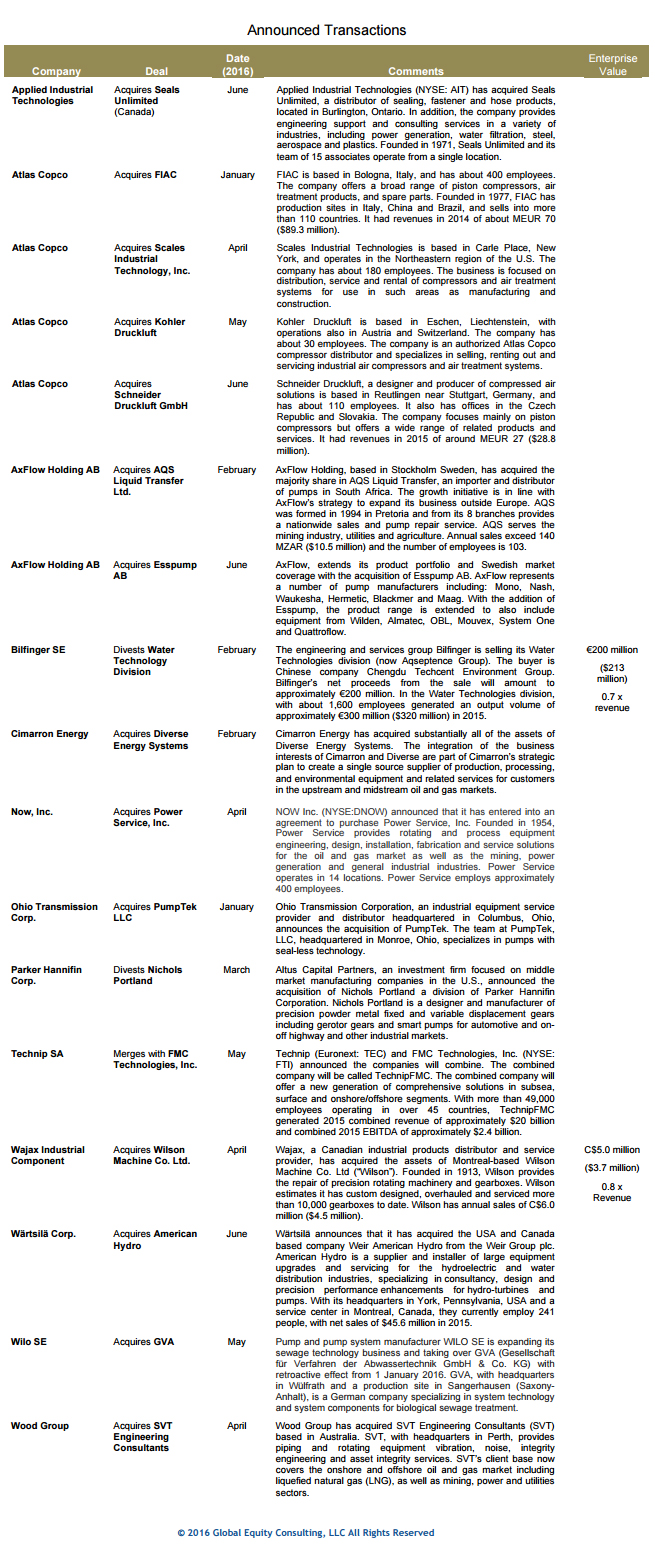

Notable Transactions – see Announced Transactions for more complete descriptions of the transactions

The most notable transaction impacting the fluid handling industry in the first half of 2016 was the announced merger between Technip and FMC Technologies. The merger creates a company with $20 billion in annual revenue and an integrated capability to serve all upstream segments of the oil and gas industry including surface, subsea, onshore and offshore.

Most Active Companies – see Announced Transactions for more complete descriptions of the transactions

Atlas Copco continued their aggressive acquisition program with four acquisitions – two piston compressor manufactures and two distributors of air compressor products

Axflow Holding AB continued their strategy to grow outside Europe with an acquisition in South Africa and expanded their footprint as well as their product line in Europe with an acquisition in Sweden.

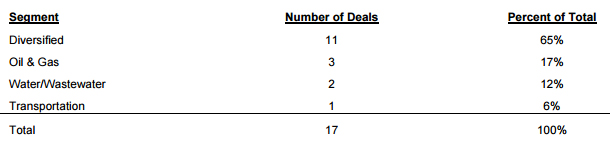

Activity by Industrial Segments

Our diversified category is comprised of target companies who serve multiple industry sectors and, as usual, is the category with the majority of the transactions. The majority of the transactions in this period (9 of 17) were acquisitions of distribution & service businesses, which tend to service multiple industry sectors.

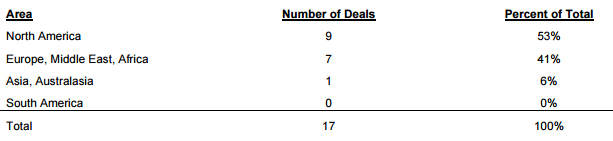

Activity by Targeted Geographies in 2015

The majority of the target companies were located in North America followed quite closely by Europe/Middle East/Africa (EMA) with over 40% of the target companies in that region. This is consistent with the mix of targeted company locations that occurred in 2015 and represents a continuation of a high level of interest in targeted companies based in Europe.

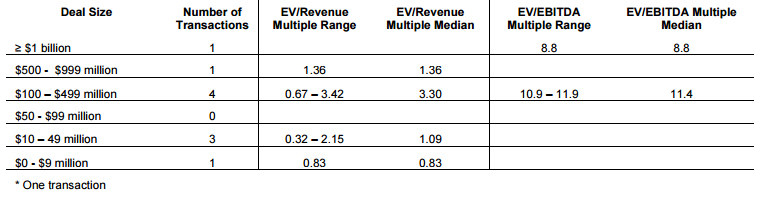

Fluid Handling Industry Disclosed Transaction Valuations for the Last Twelve Months (LTM) ending December 2015

Note: Amounts shown as $ are USD unless noted otherwise. Currency conversions are done at the average exchange rate for the month in which the transaction is announced. Prior year amounts are converted at the average exchange rate for relevant period.

Sources: Company Announcements, Capital IQ and SEC Filings

Terms: EBITDA – earnings before interest, taxes, depreciation and amortization; EV – enterprise value is the combined amounts of market capitalization, minority interests, preferred stock and net debt; Revenue – amount recorded as net sales for the period.

Disclaimer: The information provided in this report is not intended to be used for valuation, market comparison, investment or other transaction related purposes.

Contact: Thomas Haan, Principal Global Equity Consulting, LLC FINRA registered investment banking representative associated with City Capital Advisors, a FINRA registered broker-deal and SIPC member Chicago IL (www.city-cap.com) thaan@GlobalEquityConsulting.net • T 269 385 5186 • www.GlobalEquityConsulting.net © 2016 Global Equity Consulting, LLC All Rights Reserved.

Comments