Q3 & Q4 2016 Market Report

This is a report on merger and acquisition transactions announced in the third and fourth quarters of 2016 for manufacturers, distributors or service providers for dynamic (rotating or reciprocating) fluid handling equipment and related products -except drivers – for industrial markets. The report is compiled by Global Equity Consulting, LLC and City Capital Advisors.

Global Equity Consulting and City Capital Advisors provide merger and acquisition and strategic advisory services including buy-side and sell-side representation, debt and equity capital formation, leveraged buyouts and ownership recapitalizations.

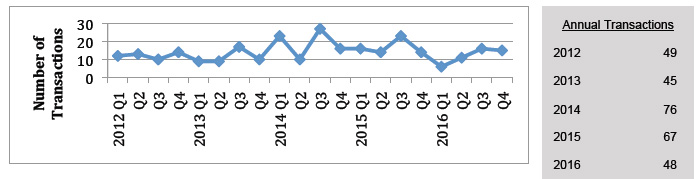

Industry Deal Activity Level

The deal volume in 2016 returned to a more normal level after two years of extraordinary levels of activity. There were 48 transactions in 2016, which is down substantially from the high levels of 2014 and 2015 but at about the same levels we saw in 2012 and 2013. The industry transaction activity in the second half of 2016 declined 16% from the second half of 2015 with 31 announced transactions in the second half of 2016 compared to 37 announced transactions in the second half of 2015. However, sequentially the deal activity increased substantially, almost double, in the second half of 2016 with 31 transactions compared to only 17 in the first half 2016. The trends in deal activity in the fluid handling industry were consistent with the trends in the broader M&A market with a pick-up in activity in second half of the year but a slow-down in activity for the full year vs. 2015. However, despite the reduction in deal volume the valuations remained strong as strategic buyers looked to enhance their growth opportunities through acquisition and private equity firms looked to put their record level of dry powder to work. There was a noticeable increase in transactions targeting distribution and service businesses, which accounted for 52% of deal activity in 2016 vs. 37% in 2015. This may be a reflection of the consolidation that has taken place in the manufacturing sector of the industry, while to date there has been significantly less consolidation in the distribution and service sectors.

Figure 1: Announced Transactions 2011 – 2015

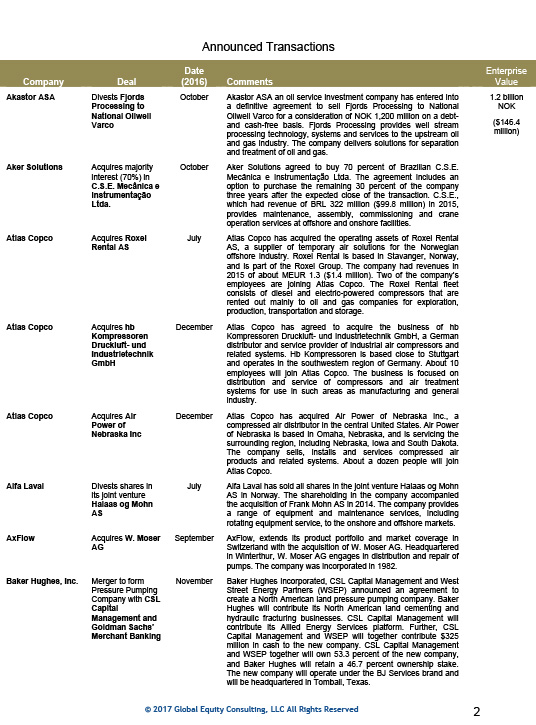

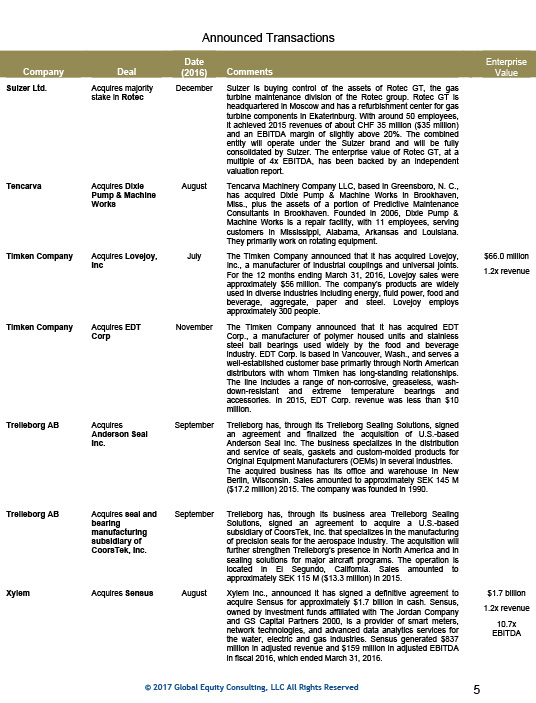

Notable Transactions – see Announced Transactions for more complete descriptions of the transactions

The most notable transaction impacting the fluid handling industry in the second half of 2016 was the announced merger between GE Oil and Gas and Baker Hughes. The merger creates an equipment, technology and services provider to the oil and gas industry with $32 billion in annual revenue and operations in over 120 countries.

Other notable transactions in the second half of 2016:

• Pentair sold their valves and controls business to Emerson Electric in transaction valued at $3.15 billion

• Xylem acquired Sensus in a transaction valued at $1.7 billion

Most Active Companies – see Announced Transactions for more complete descriptions of the transactions

Atlas Copco continued their aggressive acquisition program with three acquisitions in the second half of 2016; a rental business and two distribution/service companies.

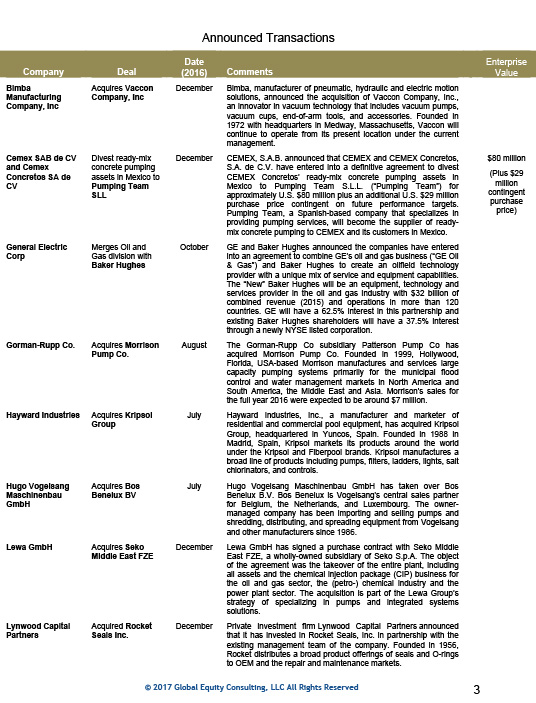

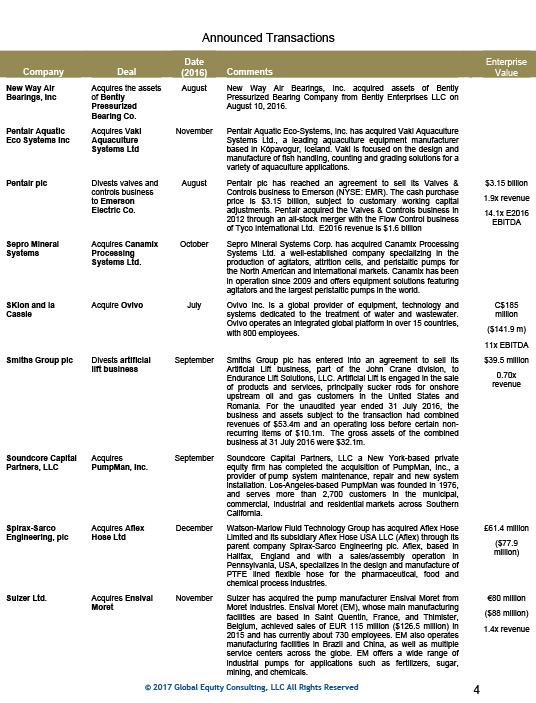

Other companies with multiple transactions in the second half of 2016:

- Pentair plc……….2

- Sulzer Ltd……….2

- Timken Co……….2

- Trelleborg AB……….2

Companies with multiple transactions for the full year 2016:

- Atlas Copco……….7

- AxFlow……….3

- Pentair……….2

- Sulzer……….2

- Timken……….2

- Trelleborg……….2

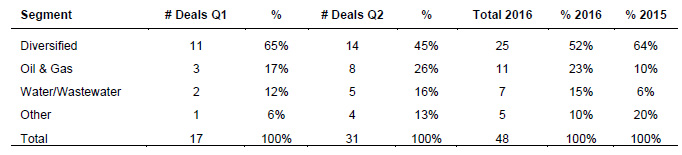

Activity by Industrial Segments

Our diversified category is comprised of target companies who serve multiple industry sectors and, as usual, is the category with the majority when categorized by markets served. However, in 2016 we saw a significant change in mix with an uptick in transactions with companies who primarily serve oil & gas and water industrial markets.

There was also an increased interest in distribution and service businesses, which accounted for 52% of the deal activity in 2016 compared to 37% in 2015.

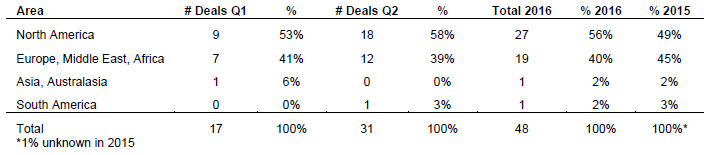

Activity by Targeted Geographies in 2015

The geographic target areas have been relatively consistent despite the diverse political and economic uncertainties of the various regions of the world. There continues to be little to no fluid handling industry M&A activity in the emerging economies.

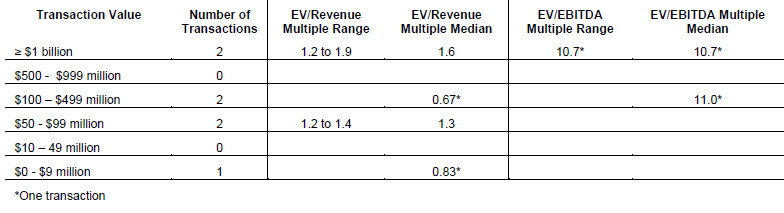

Fluid Handling Industry Disclosed Transaction Valuations for the Last Twelve Months (LTM) ending December 2016

Note: Amounts shown as $ are USD unless noted otherwise. Currency conversions are done at the average exchange rate for the month in which the transaction is announced. Prior year amounts are converted at the average exchange rate for relevant period. Sources: Company Announcements, Capital IQ and SEC Filings Terms: EBITDA – earnings before interest, taxes, depreciation and amortization; EV – enterprise value is the combined amounts of market capitalization, minority interests, preferred stock and net debt; Revenue – amount recorded as net sales for the period.

Disclaimer: The information provided in this report is not intended to be used for valuation, market comparison,

investment or other transaction related purposes.

Global Equity Consulting and City Capital advisors help private business owners:

• Understand the current market value of their business

• Help to provide insight on how to create additional value

• Provide support to plan and execute a transition of ownership

Contact Global Equity Consulting for a confidential consultation.

Comments