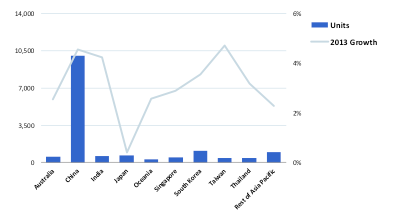

The Chinese pump market is massive, making up more than 60% of unit shipments in Asia Pacific. This percentage is expected to rise above 65% by 2017, when annual pump sales in China are expected to reach nearly 13.5 million units. Though the Chinese market is well-poised for substantial growth over the next five years, it is not clear which pump producers will be able to best take advantage of this expansion. Because of the positive long-term growth forecasts for the Chinese economy, many pump suppliers are confident in their ability to open new facilities in China and compete with local manufacturers. This influx of international companies has introduced a new dynamic to the competitive environment in the country, and the Chinese pump market is undergoing a major transition as a result.

Chinese manufacturers produce pumps that are typically only 80% as efficient as pumps manufactured in other developed regions of the world. As a result, international companies that operate in China have been able to take the most advantage of a recent government subsidy program that encourages the use of energy-efficient water pumps. The subsidy is granted to any manufacturer that produces compliant energy-saving pumps in mainland China. This has encouraged companies like Grundfos, Wilo, Sulzer, KSB, and many other foreign pump suppliers to greatly expand their presence in China. Several larger Chinese pump producers like Shanghai Liancheng, Hunan Neptune, Nanfang, and Shanghai East have also enjoyed the program’s benefits since its implementation late last year.

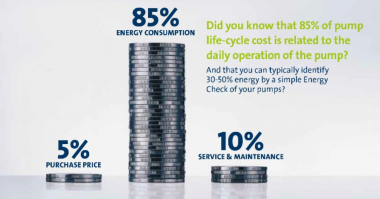

The smaller Chinese suppliers typically do not have the economies of scale or technical capabilities to manufacture water pumps that qualify for subsidies such as this one. However, the large majority of customers still focus more on the pump’s initial cost than its long-term energy-savings potential, so the inability to take advantage of the subsidy has not had a significantly negative impact on these smaller companies. Currently, the local Chinese companies account for well over half of the country’s pump market. If this year-long subsidy program (which ends in November of 2013) is a precursor for broader energy-efficiency mandates that may be enacted in the future, the international players will be well-positioned to increase their market share in China. Whatever the outcome, pump suppliers should be aware of the possible structural changes to the competitive landscape that will ensue as a result of the Chinese government’s future regulation of energy-using products.

For more information, contact me at Preston.Reine@ihs.com

Good article