Current status of the capital equipment market

Since the end of 2014, sinking oil prices have had a negative impact on capital equipment vendors, especially pump and compressor manufacturers. Pumps and compressors are the heart of the process industries, so it is important to understand where they are used and how these markets will perform amid the current challenges that stem from the current oil price crisis. According to two recent reports by IHS on the world markets for centrifugal pumps and industrial air & gas compressors, spending on this equipment is expected to decline even further in 2016 and 2017. Upstream pump and compressor system spending is expected to dwindle from a combined $10.6 billion in 2015 to $9.8 billion this year. This indicates a substantial slowdown in exploration and production, which of course will have adverse effects on related oil and gas activity. The extended oil price crisis will cause pump and compressor manufacturers to continue to struggle to achieve profitability and secure new orders. These companies must therefore attempt new strategies and manufacturing methods to remain competitive.

Other avenues for new orders and revenue growth

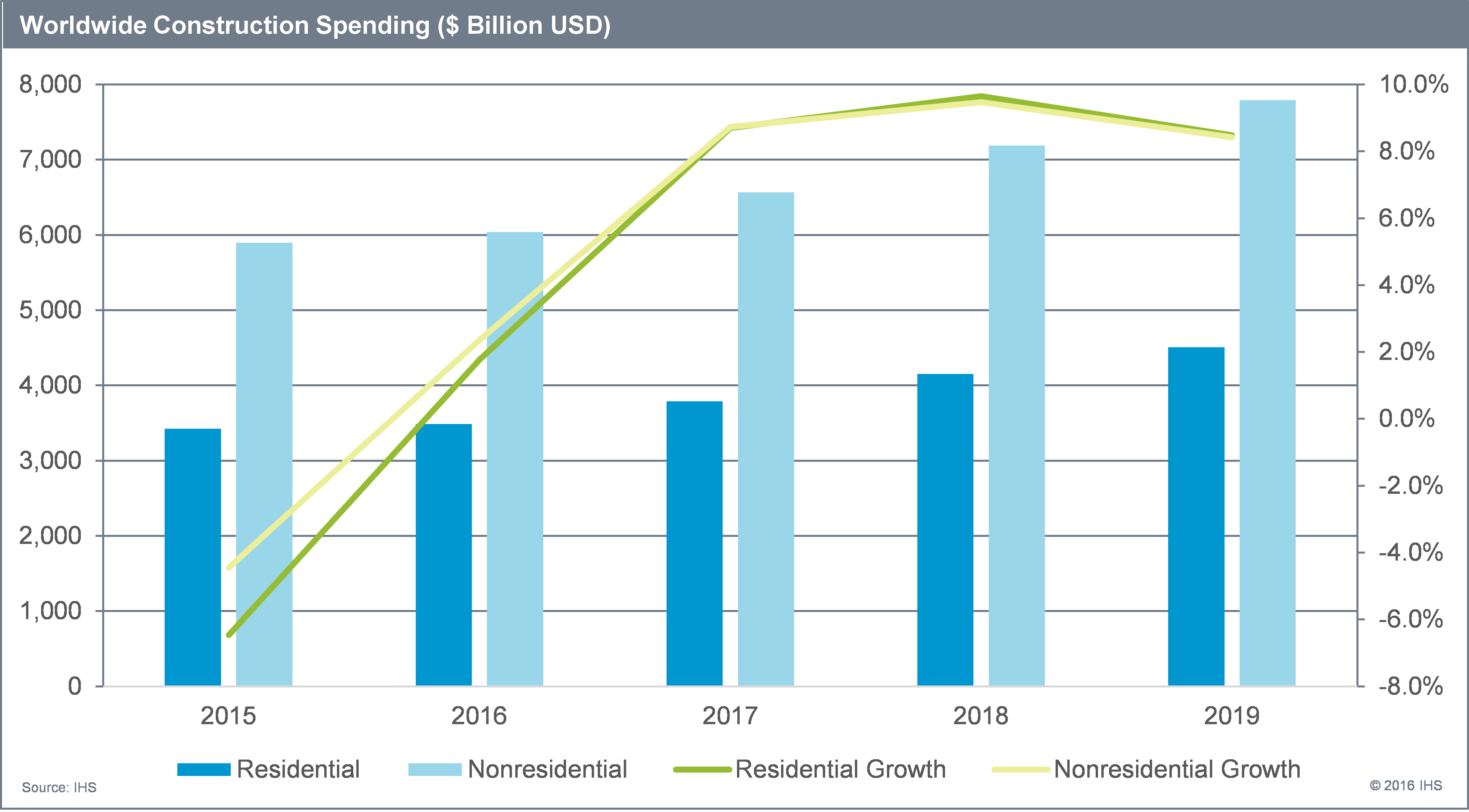

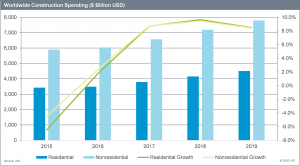

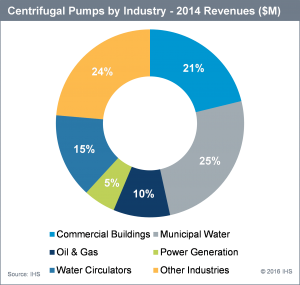

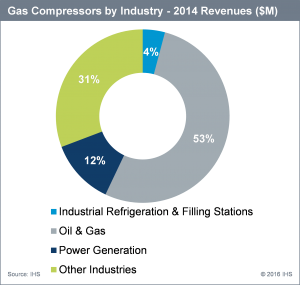

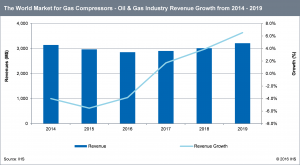

Some industries, such as water and wastewater, construction, HVAC, and food and beverage, benefit from a drop in oil prices. As a result, IHS expects them to be among the most competitive industry sectors over the next couple of years. Construction spending is a leading indicator of these sectors’ performance; IHS forecasts worldwide construction spending to grow with a CAGR of 7.2% from 2015 to 2019 (Figure 1). While the markets in these sectors may serve as bright spots for pump and compressor suppliers, careful analysis shows that energy-intensive industries account for a large proportion of pump and compressor market revenues. Specifically, in 2014, the oil and gas industries accounted for 10%, 32% and 53% of centrifugal pump, air compressor and gas compressor revenues, respectively (Figures 2a-2c). These figures do not include revenues attributed to power generation, mining, chemical, and other process applications that are closely tied to the performance of the oil and gas industry.

For many pump and compressor suppliers it is now clear that the tough times are not quite as near to an end as previously expected. Though not all industries will feel the negative consequences of the current oil price debacle, many suppliers will be unable to take enough advantage of those available opportunities, further exacerbating the slowdown in the pump and compressor market. One manufacturer reported to IHS that it is bracing for the “worst downturn in the turbomachinery market in the past two decades.”

Figure 1:

Figure 2a:

Figure 2b:

Figure 2c:

Market structure of pump and compressor manufacturers

Pumps can be sold to a wider range of industries than compressors. This is crucial in identifying which companies can secure new orders and attain profitability under trying economic conditions. Figure 2a shows that many industry sectors use pumps but that compressor revenues are more closely tied to the energy-intensive sectors. Municipal and utility-based sectors are currently faster than the average, so many more suppliers will try to gain market share in these industries. Still, there are not enough projects for every manufacturer to benefit from the growth of these markets; therefore, the municipal water and wastewater, commercial and residential sectors are expected to become increasingly competitive. This competitiveness will also halt any price increases for pump and compressor equipment since these industries are price-sensitive.

Supply of industrial pumps and compressors is becoming more concentrated, and in new ways. The past few years have seen many pump suppliers acquire other pump suppliers, and the same is especially true of compressor OEMs acquiring competing vendors. Recently, however, pump and compressor OEMs have been in merger, acquisition and partnership activity with motor, drive and other industrial automation manufacturers. These are clear efforts to broaden their product offerings and satisfy a wider range of customer needs. As fewer projects become available (especially in the energy sector), suppliers need to be able to expand their global presence while also satisfying local content requirements, to offer a broad range of high-quality services (specifically analytics and connectivity-based services), and to produce highly efficient and custom-designed pump and compressor systems. “Systems” is an important distinction, of course, because pump and compressor engineers are expected by their customers to be able to service equipment and to optimize the whole supply train in which pumps and compressors operate.

Strategy: How pump and compressor OEMs can counteract the downturn in turbomachinery sales

Pump and compressor vendors are being pushed more than ever to become full solutions providers and engage with their customers along the whole supply chain. Their main focus is profitability; the sinking cost of raw materials has directly translated to a reduction in pump and compressor sales prices by up to 30% in many energy-intensive applications. Because of that, OEMs have accepted lower sales prices to secure orders in which they will gain a service contract to make up lost profits later. Many advanced suppliers even offer to monitor factories and plants for free, even if they use competitors’ equipment. This is a good way to become embedded into customers’ operations and understand exactly what they require.

Increased monitoring and analytics will also lead to more demand for custom equipment that can satisfy each end-user’s specific needs. Custom-designed pumps and compressors are forecast to account for a larger percentage of sales; end-users have reported a growing need for highly engineered products to drive efficiency and reduce operating costs. Another bright spot for pump and compressor suppliers is that the average price of custom-designed pumps and compressors is forecast to increase from 2015 to 2019, a good opportunity for their suppliers to avoid price erosion and recover revenue losses from the fewer projects in this period.

With profitability a key struggle, some have introduced really innovative pump and compressor designs. The technical expertise to carry out advanced engineering is easily a top commodity for any manufacturer that is fighting to mitigate the effects of the continued downturn in the market for turbomachinery.

Pump and compressor market performance: what to expect

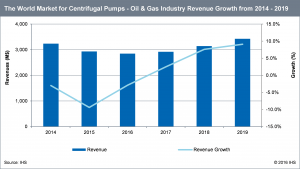

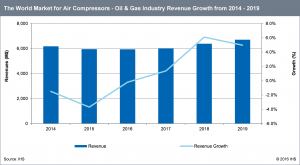

Amid falling oil prices, pump and compressor suppliers have few growth opportunities, and the downturn for the energy-intensive industries that use this equipment is forecast to persist to the end of 2017 and early 2018. Revenues for, centrifugal pumps, air compressors and gas compressors from the oil and gas industry are forecast to fall from 2014 to 2017 with compound annual growth rates (CAGR) of -3.4%, -0.9% and -2.6%, respectively (Figure 3a – 3c). After this three-year period of decline, IHS forecasts the market for pumps and compressors in oil & gas applications to grow back towards 2014 levels as oil prices return to historical levels. On the other hand, the pump and compressor markets are expected to grow faster than the average rate in the commercial buildings, food and beverage, pneumatic tools, and municipal water sectors. IHS has found that it is too broad of a statement that all turbomachinery manufacturers are facing a crisis; because there are still many growth opportunities for several of them. Unfortunately for suppliers of gas compressors, the outlook is much bleaker. While the centrifugal pump and air compressor markets declined in 2015, IHS forecasts them to bounce back in 2016; the forecasted revenue CAGRs for centrifugal pumps and air compressors from 2014 to 2019 are 3.8% and 2.3%, respectively. However, IHS forecasts gas compressor revenues not to rise until 2017, when they will grow by less than 1.0%. The forecasted revenue CAGR for gas compressors from 2014 to 2019 is -0.3%.

The IHS forecast reflects the main effect of the falling oil prices as a weak performance in the energy sectors. While gas compressor suppliers are more exposed to this downturn, pump and compressor suppliers that can tailor their products to the sectors that benefit from lower oil prices to mitigate the problem, and broaden their customer base. While they face many tough challenges, innovation and intelligent manufacturing initiatives are still driving forces in these markets; IHS believes they will greatly reduce the full impact of the ongoing oil price crisis.

Figure 3a:

Figure 3b:

Figure 3c:

Data in this press release is derived from the two recently published reports by IHS on the world markets for centrifugal pumps, and for industrial air and gas compressors. For more information about this research please contact the lead analyst with the information below.

Preston Reine

Senior Analyst, IHS

+1 (512) 582 – 2059

Comments