A new wave of drilling activity in the hydraulic fracturing sector has kick-started demand for water management solutions in a sector that was lagging less than a year ago. With a rebound in drilling activity underway, energy company spend on U.S. water management is forecasted to rise 47% by the end of 2017, according to Bluefield Research’s new Market Insight, Water for U.S. Hydraulic Fracturing Market: Competitive Strategies, Solutions, and Outlook, 2017-2026.

“Oil prices are up 62% from last year, and the impact on water demand is following in step. This turnaround, from the industry’s collapse, has thrust upstream oil & gas into a new phase, one in which water services are even more critical at US$50 per barrel of oil,” says Bluefield President Reese Tisdale.

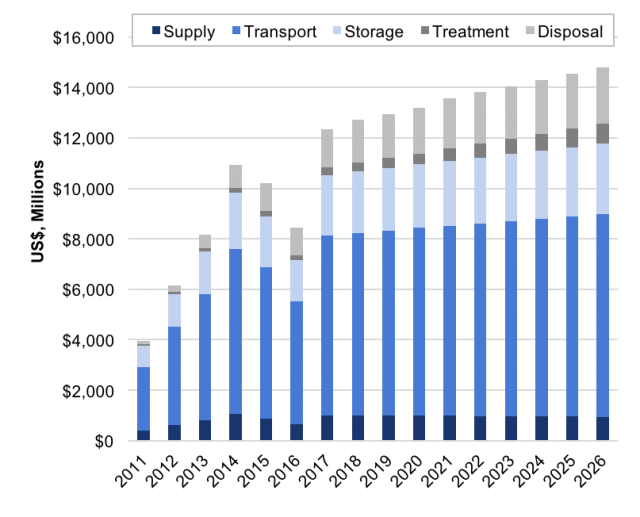

Over the last six months, the stabilization of oil prices and new drilling techniques has created a surge in drilling activity, reversing the downturn in water management spending for hydraulic fracturing from previous years. According to Bluefield’s analysis, energy companies will spend more than US$136 billion from 2017 to 2026 on water management- including water supply, transport, storage, treatment and disposal.

Increased innovation in the hydraulic fracturing sector, including techniques to drill faster and generate more production at each well, are leading to shifts in water strategies. Demand for water solutions is rising exponentially, because of increased water volume per frack and an almost 30% reduction in time to complete a well. In some basins, well completions require as much as 12 million gallons of water per frack- triple the water volumes needed five years ago.

From 2017 to 2026, more than 20 billion barrels of water will be required to serve the U.S hydraulic fracturing market at today’s rig count. Cost of water transport, rather than availability, has become the primary concern for most energy companies.

Transportation will represent the lion’s share of spending, totaling US$75.8 billion from 2017 through 2026. “There are a number of ways companies are addressing the cost of transport, including water pipelines new business models, such as alternative water supply contracts, and mobile treatment,” says Tisdale. These market shifts are also influencing the competitive landscape- both in energy and water. The debt-laden energy sector has experienced over 110 bankruptcies in recent years, but those remaining will benefit from a more experienced sector. A heightened focus on water has also led to an emerging group of midstream water service providers. Several firms, including Antero Midstream, Noble Midstream, Rice Midstream, NGL Energy, are poised to benefit from their production companies’ energy positions. At the same time, a number of private equity backed firms are positioning to address the sector’s water challenges through pipelines, treatment, and disposal.

“The value of water has clearly taken on greater financial importance for exploration & production companies. Cost reduction, efficiency improvements, and risk mitigation to water stress are a high priority,” says Tisdale. “However, there is not a one-size-fits all approach to water management. High disposal rates and salinity levels are an issue in Marcellus, while seismic activity in Oklahoma is prompting tighter regulatory controls on disposal wells. Whatever the case, the signs are positive for water services companies.”

About Bluefield Research

Bluefield Research provides data, analysis and insights on global water markets. Executives rely on our water experts to validate their assumptions, address critical questions, and strengthen strategic planning processes. Bluefield helps key decision-makers at municipal utilities, engineering, procurement, & construction firms, technology and equipment suppliers, and investment firms advance their water strategies. Learn more at www.bluefieldresearch.com.

Comments