IIoT based technologies to form the cornerstone in redefining plant maintenance approach

The onset of connectivity and digitalization is gradually gaining momentum as end-user industries redefine their investment strategy to unleash new growth opportunities. Their exposure to uncertain economic conditions, fluctuating currency rates, slow recovery of oil prices, soaring cost of raw materials and energy prices over the last five years has severely depleted the profit margins of end-users resulting in mounting operational expenditures (OPEX). Accounting the impact of these factors, end-users are proactively exploring new revenue streams and are keenly assessing the role and contribution of disruptive technologies such as Industrial Internet of Things (IIoT). The presence of such volatile business environment encourages product innovation and development and creates the need for value-added solutions such as smart and intuitive pumps over mere products that are placed in the plant.

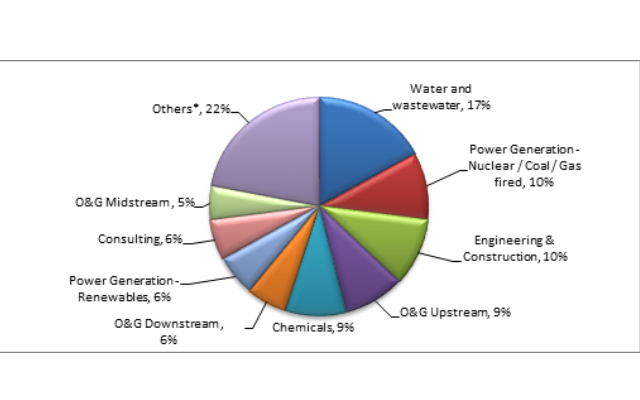

In the second quarter of 2018, Frost & Sullivan conducted an extensive survey on the emergence of IIoT and its impact across various end-user industries of pumps. More than 250 market participants from process and hybrid industries, details provided in Figure 1, expressed their viewpoints and strategic plan to integrate the next generation technology in their manufacturing plants. At this junction, the results were optimistic where end-users are gradually showing keen interest in embracing these disruptive technologies to the manufacturing processes.

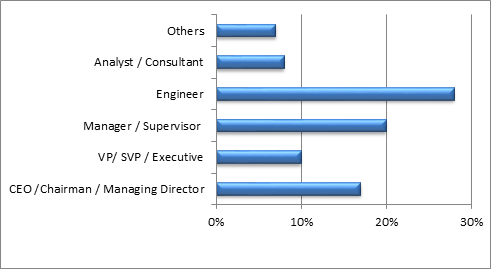

Also, the titles of these interviewees ranged from CEO’s and Chairmen to Maintenance Managers & Engineers of leading organizations.

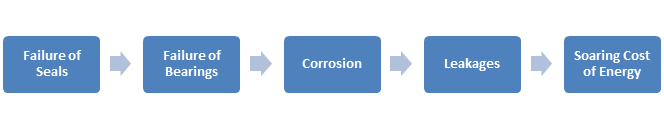

A common challenge that manufacturers across industries constantly strive to address is limited capability to diagnose and predict the scope of asset failure and reducing its consequent shutdown of plants. Due to lack of effective and efficient maintenance strategy where plant operators and engineers have limited accessibility and visibility on the performance on asset especially critical pumps, poses a huge risk leading to unplanned downtime and delayed production. To mitigate this risk, end-users are receptive to asset monitoring solutions that assist in evaluating the (i) mean time between failure and (ii) cost of failure. Several end-user industries, nearly 80% of the interviewed participants depend on vibration walk around to inspect the critical assets in the plant. The survey highlights that majority of the pump failures are caused by mechanical seals and is followed by the wear and tear of pumps, misalignment of shafts, failure of couplings and bearings that represent a small portion (20-30%). At present to inspect and detect these probable failures, nearly 80% of the end-users rely on vibration walk around and assess the performance of the bearings which on an average take around 3-6 months to fail. These manual inspections are performed to diagnose the failure of bearings in advance and replace it in order to reduce their maintenance expenditure.

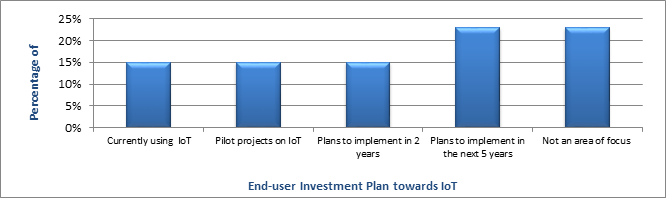

When we quizzed the management, engineering and maintenance team across various end-user industries about their investment plan, they indicated that plant modernization with IoT based solutions is imperative and forms the central theme for the next five years.

To aid end-users to predict asset failures, pump manufacturers have introduced continuous vibration monitoring solutions and these are widely used by end-users to track the performance of critical pumps in the plant. These systems raise alarms and send alerts to the maintenance operator in the control room and help to perform advanced diagnostics with handheld devices. However there are limitations on the need for next level of asset inspection involving prognostic analysis as participants remain uncertain on data reliability and set of variables included for measuring the asset health. In most of the end-user plants, pump performance is measured and monitored based on vibration analysis as obtaining this data is relatively easier as compared to pressure and flow. In fact more than 50% of the interviewed participants have already deployed IoT monitoring solutions for the critical process pumps in their plants. However when it comes to non-critical process pumps and utility pumps, end-users refrain to have this solution predominantly due to the cost of investment. Based on the viewpoints expressed by the market participants, the ability of asset monitoring solution designed with statistical tool that monitor holistic range of parameters such as voltage current, vibration, pressure and flow levels to name a few and importantly help in identifying and understanding the factors causing asset failure is likely to be more attractive and lucrative option for pump manufacturers.

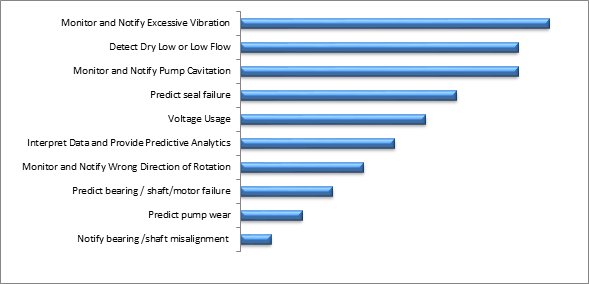

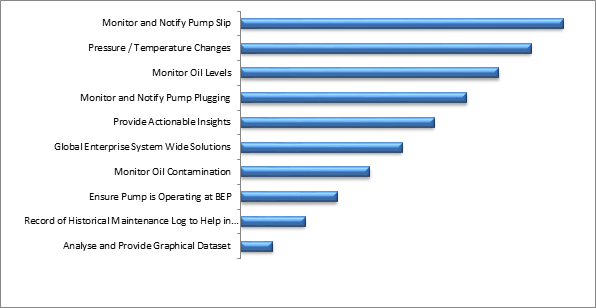

In the below chart (Figure 5), IoT monitoring system that monitors and notifies excessive vibration, pump cavitation, flow and voltage; prediction of seal failure and; data interpretation are indispensible functionalities that end-users expect from the solution. In addition to this, they have highlighted additional features such as notification of shaft and bearing misalignment, pump slip, changes in pressure and temperature, oil levels and pump plugging; data insights driving decisions; and enterprise wide system (shown in Figure 6) will help to enhance their plant maintenance approach.

A combination of these aforementioned features offers the twin benefit of achieving asset reliability and optimization. In the present scenario with higher dependency on vibration walk-around for asset inspection, our survey indicates that less than one percent of the pumps are regularly monitored. This is expected to stimulate demand for monitoring solutions in the long term.

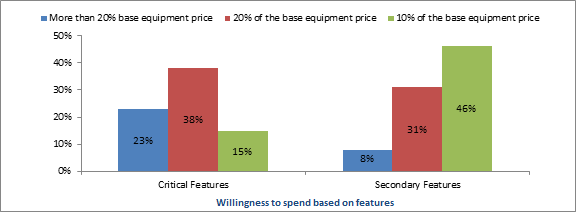

With respect to the market opinion on the cost of investment, on an average 5% to 10% of their capital budgets are allocated towards these plant modernization activities. End-users have expressed that they are willing to spend on IoT monitoring solutions with nominal upfront cost having recurring service fees. Moreover they prefer to partner with vendors whose price range of 10% to 20% of the base equipment price (refer to figure 7) as at this point there is limited visibility on the return on investments.

From an adoption standpoint, amid the various industry verticals water and wastewater has been the most receptive segment where several investments are made and planned towards plant modernization that is inclusive of asset monitoring and IIoT. Several entities have been actively upgrading their water treatment plants with smart meters with the objective to optimize the process and fulfill the growing demand. As a next step, companies have planned to invest in IIoT based solutions that helps to acquire and interpret the data generated from these assets with power of algorithms and machine learning capabilities that aids to predict failures, increase productivity and drive innovation. However the degree of investment in IIoT is largely governed by the water sector’s legal framework. This is followed by the chemicals and power generation industry that have been using remote monitoring, vibration analysis and safety alerts for their plants over decades. In fact majority of the companies interviewed perform monthly vibration walk-around as part of their plant maintenance. However these methods have limitations with respect to gaining insights on corrosion, health condition of seals, pumps and bearings.

In addition to this, it is observed that of the various IoT monitoring solution providers which includes pump manufacturers, automation and ICT vendors, and third party providers, end-users perceive that automation vendors are better positioned to deliver cost-effective solution with comprehensive features and possess the ability to demonstrate the return on investment (ROI).

Cost-effective and secured asset monitoring solution with end-to-end encryption of data acquired from assets and are retained within the plant site is gaining interest in this industry. Mining, food and beverage, and pulp and paper are the most conservative industries where the large MNCs only employ asset monitoring solutions. The plant engineers interviewed had concerns with respect to the investment involved and their plant maintenance was confined to manual inspections to detect any failures, replacement and service need for their assets. As these industries prefer reactive approach towards plant maintenance, transition towards preventive and predictive is expected to be slow and hence likely to have lower demand for advanced monitoring solutions.

With the presence of diverse end-user requirements, pump manufacturers continue to expand asset monitoring capabilities with the integration of data visualization software, analytical platform, cognitive intelligence and industrial mobility. When end-users were questioned about their criteria for selecting asset monitoring solution, it was expressed that vendors with respective product expertise is likely to be preferred partner for these value-added services. However they are open to vendors with proven track record and strong domain expertise to assist end-users in redefining their plant maintenance approach.

In a nutshell, Frost & Sullivan research survey reveals that end-users have initiated investment plans towards digitalization where they plan to achieve 30% of their objectives by 2021 and there is likely to be an uptake in these investments over the next ten years. Though end-users who were surveyed expressed their focus towards revisiting their IT-OT policies a significant portion (nearly 75%) remains skeptical about the adoption of IoT based monitoring solution due to cyber security and data privacy. The market is likely to witnessed mixed demand for the asset monitoring solutions in the short term and is expected to accelerate in the long term as industries impose stringent policies that reinforce confidence to embrace IoT based technologies.

Comments