The rise in urbanization and environmental concerns has greatly increased the demand for sustainable energy and low emissions, with natural gas being a preferred source of fuel for electricity generation and heating, especially in North America. The annual energy outlook (AOE) for 2015 by the US Energy Information Administration (EIA) has forecast natural gas production in the U.S. to increase from about 24 trillion cubic feet to 35 trillion cubic feet by 2040. The EIA–AOE 2015 also forecasts natural gas production to increase significantly with a major contribution from sources such as shale gas, tight gas, and coal-bed methane.

The vastly expanding shale play in the North American region has resulted in enhancing the natural gas market in the United States. The shale boom in the U.S. has been a major invigorator for the development of the natural gas transportation industry and sole cause of liquid natural gas export from the U.S. The shale gas production from 1% of the total U.S. natural gas production in 2000 reached over 20% by 2010 and is expected to go up to 46% within the next 20 years. The major hotspot reserves with high productivity, contributing more than 70% of the overall tight oil production, would be the three basins in the United States— Utica, Marcellus, and Haynesville basin formations. The natural gas transportation capacity is set to increase by 24.2 Bcfd over the next decade which is a clear indication of the upcoming greenfield projects in the midstream sector for gas transmission.

The oil and gas midstream industry includes three major segments: transportation, gathering and processing, and storage. The transportation segment includes waterborne, rail, road, and pipeline modes for the transfer of oil and gas from the exploration site to gathering and processing units. Thereby, the natural gas transportation sector of North America can be classified into transfer via road though trucks and railcars, pipeline transfer, and LNG export terminals for offshore transfer. The demand for industrial valves market for gas handling is expected to increase in all three segments.

There are numerous midstream pipelines projects planned for gas transmission both in the U.S. and Canada, with more than 200 pipelines running for 300,000 kilometers are expected to be built by 2035. With the growth of the midstream pipeline gas transportation sector, there is high demand anticipated in the large bored engineered valves market in North America. The large bore industrial ball valves and through conduit gate valves are the two major types of valve technology used for isolation application in pipeline transmission. Due to the abrasive nature of shale gas, pneumatic actuation is being replaced by electro-hydraulic actuators for valve operation. However, the high investment midstream pipelines projects in Canada such as the Northern Gateway and Trans-Mountain pipelines are currently under severe scrutiny due to concerns over environmental safety. The authorization of these pipeline projects would result in further increased demand for large bore engineered valves

Planned Pipelines and LPG Export Terminals for Gas Transmission in North America

The large-scale overseas transportation of gas is extensively carried out by compressing natural gas to liquid natural gas (LNG) in order to reduce the volume during transportation through LNG tankers. LNG occupies around 1/600th the volume of natural gas in its gaseous state. Currently, about 30% of global natural gas imports are in the form of LNG, with further growth expected.

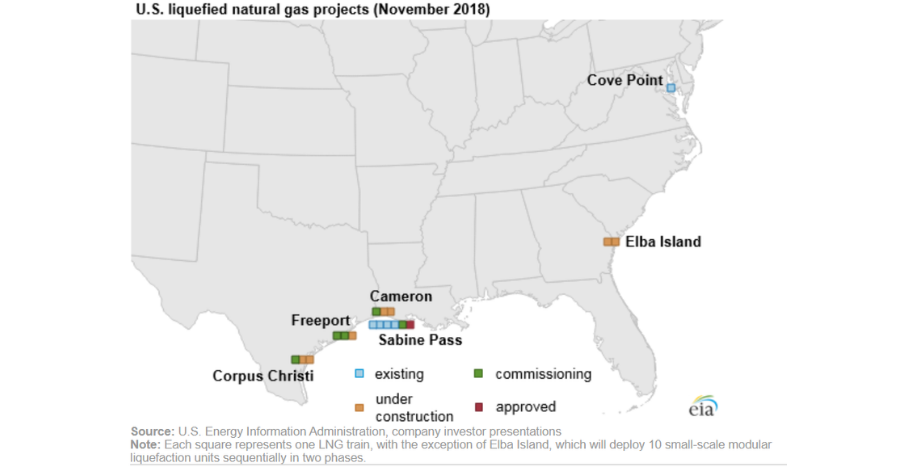

As of September 2015 in North America, 5 LNG export terminals are under construction and about 25 LNG projects are planned by the Federal Energy Regulatory Commission (FERC). The natural gas from the pipelines is further accumulated and includes dehydrating, treating, conditioning, and processing before compression. On liquefaction the fluid handling temperature and pressure may vary to a maximum of -160C and 250 bars, respectively, thereby involving operational equipment suitable for cryogenic and severe service applications. Cryogenic and severe service valves include a range of quarter-turn and multi-turn valves for both isolation and control, with the ability to operate at an optimum range and retain the flow characteristics for repeated cycles, well below freezing temperature.

Industrial Valves in Natural Gas Transmission – Segmentation

Due to the recent fall in global oil and gas prices, several greenfield oil and gas projects across the industry have been deferred by major petroleum energy corporations in both U.S. and Canada. U.S. gas-driven projects specifically are increasingly at risk and have lost their competitive edge. Based on current LNG prices in the Middle East, Africa, and Asia, the competitive advantage for U.S.-based natural gas brownfield projects has almost completely disappeared. This has resulted in a stalling growth of the LNG processing industry in North America and the relative demand for industrial valves in LNG applications. However, there is good scope anticipated for the full-scale development of Micro LNG’s in the U.S. after 2018.

The gas transportation through rail infrastructure has increased by 35% and 43% in Canada and the US, respectively, between 2011 and 2013. The concept of Micro LNG plants at well-head production areas to control the excess natural gas flared into the environment is being undertaken, with numerous commercial units due for establishment. Around 15 LNG small-scale plants are operational in the North American region which produces around 1.2 million gallons per day and more than 8 projects are under construction stage having the capacity of 0.75 million gallons per day which is expected to be operational by the end of 2015. The market size of Micro LNG market in North America is estimated at about $ 400 million for 2015 and expected to grow at a CAGR of 12% by 2020. This should also boost demand for small-bore process valves.

In summary, while areas of the oil and gas value chain have been experiencing challenging scenarios, opportunities are expected in specific areas of the natural gas transportation sector over the next several years.

Comments