Pumps Market will surpass USD 91 billion by 2025, according to a research report from Global Market Insights.

Based on position, pumps are categorized as of two types submersible and non-submersible. This segment is dominated by non-submersible pumps because of their growing use in surface application like pressure boosting, water transfer, turf irrigation, washdown application, storm water, wastewater and in other areas. Submersible pumps hold a comparatively smaller market due to more restricted use in offshore areas.

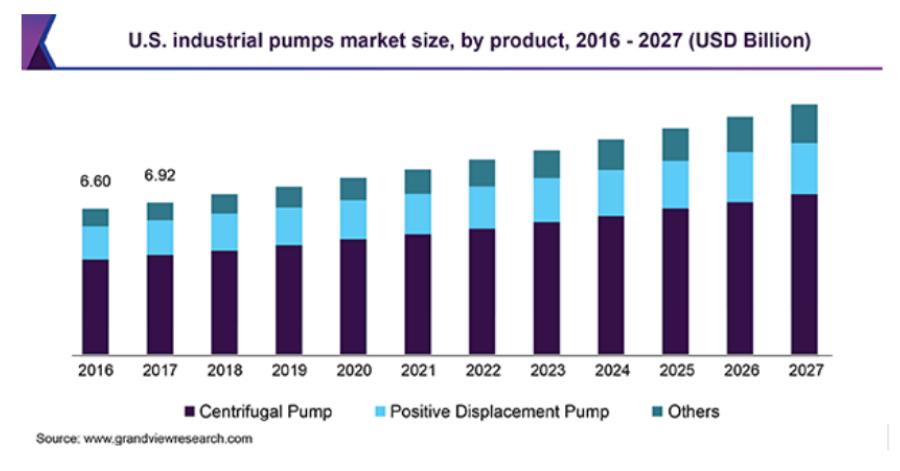

Pumps have footprints in a wide range of applications including mining, oil & gas, industrial, municipal, and other areas. The global industrial pump market size was valued at USD 62.6 billion in 2019 and is expected to expand at a CAGR of 5.9% over the forecast period. Growing expenditure on infrastructural development is expected to augment the demand for industrial pumps over the next five years.

Adoption of these industrial pumping systems is likely to increase in several end-use industries such as chemicals and petrochemicals due to resistivity towards different hazardous chemicals and durability.

U.S. industrial pumps market

Mergers & acquisitions predicted

Manufacturing journalist, Thomas R. Cutler (TRC) interviewed Fran Brunelle (FB) of Accelerated Manufacturing Brokers.

TRC: Why do you predict there will be more mergers & acquisitions in the industrial pump and equipment sector in 2021?

FB: The pump market will grow beyond the predicted 5.9 growth rate in the next 5-10 years. Much of our water supply infrastructure was put in place 75-100 years ago. It was never intended to handle its current volume of approximately 328 million people. The American Society of Civil Engineers estimates that 240,000 water main breaks occur every year, causing 6 billion gallons of water loss. They claim that loss could actually support 15 million households each day. Quality investors look for guaranteed growth opportunities, and this is one of them.

TRC: Do you find that more privately held pump and equipment manufacturers are simply looking to retire in this COVID time-frame?

FB: COVID has certainly pushed those close to retirement to consider it sooner rather than later. An aging founder who may be at higher risk will seek retirement sooner. However, younger owners are enjoying this time of growth for their industry.

TRC. Do you find that these manufacturers can capture top dollar for their businesses since competitors want to acquire both customer databases and manufacturing operations?

FB: Competitors in this industry, especially OEMs, are looking to solve for more than acquisition of the customer base and manufacturing operations. When a 75-year-old pump fails, putting a town or county’s water in jeopardy, the OEM part may no longer be made. An emergency solution must be custom made. Often an OEM solution is 12-24 weeks out. The skillset and speed needed to keep the water flowing lives in smaller, nimble, entrepreneurial pump repair companies in the lower middle market. The skill that lives in these organizations will be the subject of bidding wars in the next 5-10 years and competition will drive pricing for the acquisitions.

TRC. From an initial inquiry through due diligence to finding a buyer for a pump and equipment manufacturer, what is a reasonable or typical timeline?

FB: This is entirely a function of how organized the selling company is and whether or not they have operating systems in place and can respond with speed to requests from quality buyers. Typically, lower middle-market companies sell within one year of listing. In highly desired sectors like pump and valve, several months can be shaved off this process, provided the selling company is well organized.

TRC: What are the top reasons that a pump and equipment manufacturer is not ready to sell?

FB: Those not ready to sell are still in build mode, which is a great thing. However, owners should consider that the best time to sell is when your sales and net earnings are in an upward trajectory.

TRC: There have been very large M&A deals recently. Warburg Pincus completed the acquisition of Sundyne from funds advised by Carlyle and BC Partners. Sundyne was part of the group of companies divested by United Technologies in 2012 in a $3.46 billion transaction that formed Accudyne Industries. Sundyne was the remaining piece of Accudyne with Carlyle and BC Partners having previously sold Sullair and Milton Roy in separate transactions. Funds managed by Apollo Global Management, Inc. completed the acquisition of the SPX Flow Power and Energy business segment for a transaction value of $475 million. The divested business is now Celeros Flow Technology and consists of the following brands: Airpel, Copes-Vulcan, GD Engineering, Plenty, ClydeUnion, Dollinger, M&J Valve and Vokes. Why are the $2M – $20M pump and equipment manufacturers primed for acquisition during 2021?

FB: This is a skill set question. The larger OEMS typically can’t respond to an emergency the way smaller companies do. Making pumps in mass production is entirely different than developing a custom solution in 24 hours so that a town doesn’t lose water. This sector will have plenty of work if the American Society of Civil Engineers Infrastructure Report Card is correct. The sector growth rate will drive M&A activity.

TRC: What are the advantages of a pump and equipment manufacturer to work through a broker like Accelerated Manufacturing Brokers?

FB: The typical buyer in this sector is not local. When my firm sold New England Pump & Valve we sparked interest both nationally and internationally from some of the largest companies in the field. We know how to attract an international audience, yet be cognizant of the concerns of a founder-led organization.

TRC: Do buyers have the same strategic imperatives that were driving the strong demand for acquisitions before COVID?

FB: Buyers still want good companies that are both well organized and enduringly profitable. Buyers will be further drawn to the pump sector because the aging infrastructure makes it recession-proof and COVID proof.

TRC: To what extent has the current situation impacted buyers’ and sellers’ risk tolerance and outlook for future growth?

FB: The biggest change is for aging company owners who may have been considering remaining in business several more years before retiring. If they don’t have to do so to fund retirement, they won’t, given the potential health risk to them personally. The good news is that if they decide to exit now, the market is incredibly strong.

Frances Brunelle is the founder of Accelerated Manufacturing Brokers, Inc., focused on the sale of lower middle market manufacturing companies nationally. Additionally, she hosts the WAM Podcast (Woman and Manufacturing), which highlights and profiles the opportunities for women in senior management and ownership positions. Brunelle helps manufacturing business owners prepare their companies for sale to ensure a positive financial result. She was recently named to 2020 Most Influential Women in Mid-Market M&A in Mergers & Acquisitions publication.

Frances Brunelle is the founder of Accelerated Manufacturing Brokers, Inc., focused on the sale of lower middle market manufacturing companies nationally. Additionally, she hosts the WAM Podcast (Woman and Manufacturing), which highlights and profiles the opportunities for women in senior management and ownership positions. Brunelle helps manufacturing business owners prepare their companies for sale to ensure a positive financial result. She was recently named to 2020 Most Influential Women in Mid-Market M&A in Mergers & Acquisitions publication.

Thomas R. Cutler is the President and CEO of Fort Lauderdale, Florida-based, TR Cutler, Inc., celebrating its 21st year. Cutler is the founder of the Manufacturing Media Consortium including more than 8000 journalists, editors, and economists writing about trends in manufacturing, industry, material handling, and process improvement. Cutler authors more than 1000 feature articles annually regarding the manufacturing sector. More than 4700 industry leaders follow Cutler on Twitter daily at @ThomasRCutler. Contact Cutler at trcutler@trcutlerinc.com.

Thomas R. Cutler is the President and CEO of Fort Lauderdale, Florida-based, TR Cutler, Inc., celebrating its 21st year. Cutler is the founder of the Manufacturing Media Consortium including more than 8000 journalists, editors, and economists writing about trends in manufacturing, industry, material handling, and process improvement. Cutler authors more than 1000 feature articles annually regarding the manufacturing sector. More than 4700 industry leaders follow Cutler on Twitter daily at @ThomasRCutler. Contact Cutler at trcutler@trcutlerinc.com.

Comments