The U.S. industrial valve industry will see growth of 1.45% in valve shipments in 2018, a rate that brings the value of those shipments up to $4.615 billion for the year, according to the Valve Manufacturers Association’s 2018 Market Forecast of Industrial Valve Shipments. That rate of growth is slightly behind 2017 when it was 1.89%, which translated to shipments worth $4.549 billion.

Going forward, “The increasing tailwinds in capital spending should create growth opportunities for valve manufacturers, not only domestically, but also abroad,” said Mark Nahorski, president of PBM Inc. and chairman of VMA.

“One of those areas is the refining and petrochemical industry, where existing facilities are being upgraded to meet process efficiencies and emissions standards,” he said.

While overall industry growth is not huge from 2017 to 2018, “it translates to $66 million more in valve shipments for the year, which is a positive sign for the industry,” said VMA President William Sandler. Looking back at shipments over the last decade, the industry has gained $615 million in valve shipments, he pointed out.

The industry also has been growing since 2009, when a tumble in the petroleum and power industries meant the year saw almost no growth. “However, last year and this year, we are continuing the slow steady climb upward that has been part of our industry for the last 10 years,” Sandler said.

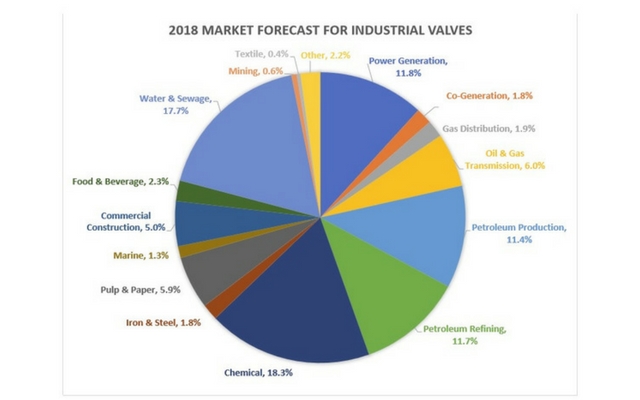

The largest growth for 2018 will come from the petroleum production industry, which will increase by over $42 million and gain almost a percentage point share in the market. It now holds 11.4% of the market compared to last year’s 10.5%.

The largest growth for 2018 will come from the petroleum production industry, which will increase by over $42 million and gain almost a percentage point share in the market. It now holds 11.4% of the market compared to last year’s 10.5%.

Remaining in top place of valve end-user industries is the chemical industry, which holds 18.3% of the market, a share that didn’t change significantly this year. The second largest market share belongs to water/wastewater, which holds 17.7% of the market, slipping by half a percentage point in 2017 or about $2.3 million less for the year.

Other energy markets continue to rank among the top users including power generation at 11.8% and petroleum refining at 11.7%. Slight gains have occurred in commercial construction and in oil and gas transmission. Those industries each hold about 6% of the market. Slight losses have occurred in pulp and paper, and iron and steel.

As far as the type of valves, automatic valves are the most-often used valve being shipped today.

“Automatic valves are outpacing conventional manually operated versions, as end users seek to remove variability and human error from the process,” Nahorski said. “Automation and controls continue to play a major role in the valve industry—the segment represents 31% of VMA industrial valve shipments for 2018 compared to 18% for ball valves,” he said.

About VMA: Founded in 1938, the Valve Manufacturers Association of America is a trade association that represents the interests of nearly 100 North American manufacturers of valves, actuators, and controls. Collectively, members account for approximately 80% of the total industrial valve shipments out of U.S. facilities. VMA is headquartered in Washington, DC.

Comments